cayman islands tax treaty

Since then the number of TIEAs that Cayman has in force has proliferated. Foreign tax relief.

Cayman Islands Exchange Of Information And Tax Enforcement

Together they can exclude as much as 224000 for the 2022 tax year.

. THE GOVERNMENT OF THE CAYMAN ISLANDS UNDER ENTRUSTMENT FROM THE GOVERNMENT OF THE UNITED KINGDOM OF GREAT BRITAIN AND NORTHERN IRELAND. Under these treaties residents not necessarily citizens of foreign countries may be eligible to be taxed at a reduced rate or exempt from US. US- Cayman Islands Tax Treaty And Cayman Islands Expat Tax.

The Agreement between the Government of the United States of America and the Government of the United Kingdom of Great Britain and Northern Ireland including the Government of the Cayman Islands for the Exchange of Information Relating to Taxes done on November 27 2001 at Washington the 2001 Agreement shall terminate on the date of entry. Article 1 Scope of the Agreement. Tax treaties Tax treaties and related documents between the UK and the Cayman Islands.

The UN describes Double Taxation Treaties DTTs as bilateral agreements between two countries which allocate taxing rights over income between those countries thereby preventing double taxation of income. Tax Agreement with the Cayman Islands will enter into force. The Cayman Islands landmark 12th tax information exchange agreement was signed with New Zealand in August 2009 moving the jurisdiction onto the whitelist of countries that have substantially implemented the OECDs internationally agreed tax standard.

The Cayman Islands competent authority. More specifically DTTs define exactly what types of income can be taxed and when they can by taxed by countries involved in a. It should also be obvious to the editor of The Economist and in fairness he draws reference to the offending EU based double treaty tax jurisdictions that the zero tax jurisdictions notably the Cayman Islands are in no way involved in the mechanics of profit shifting by way of the application of the excessive transfer pricing practices of these US corporates.

All taxes except customs tariffs. A in the Peoples Republic of China. Corporate - Tax administration.

Cayman entered into a mutual legal assistance treaty with the USA although the treaty specifically excludes financial matters. Does not have a tax treaty with the Cayman Islands and as a result there are no benefits for Cayman Islands Expat Tax from this perspective. WHEREAS the Government of the.

HM Revenue Customs. AND THE GOVERNMENT OF CANADA FOR THE EXCHANGE OF INFORMATION ON TAX MATTERS. We maintain a collection of worldwide double tax treaties in English and other languages where available to assist members with their enquiries.

Under these Agreements Cayman Islands financial institutions must provide the Cayman Islands competent authority with the required information. Corporate - Withholding taxes. On October 14 Tue mutual notification procedures were completed for entry into force of the Agreement between the Government of Japan and the Government of the Cayman Islands for the Exchange of Information for the Purpose of the Prevention of Fiscal Evasion and the Allocation of Rights of Taxation.

Currently no withholding taxes WHTs are imposed on dividends or payments of principal or interest. The Government of the Cayman Islands and the Government of the Kingdom of the Netherlands DESIRING to strengthen the relationship between them through cooperation in taxation matters have determined to accede to the Agreement hereinafter set out Have agreed as follows. Corporate - Tax credits and incentives.

Hereinafter referred to as Chinese tax b in the Cayman Islands. Canada - Cayman Islands Tax Treaty. The US Treasury announced on Friday it would cancel a 1979 tax treaty with Hungary after the country moved to block the European Unions implementation of a new 15 global minimum tax.

Cayman Islands Foreign Bank Account Reporting The FBAR FinCen Form 114. Income taxes on certain items of income they receive from sources within the United States. These reduced rates and exemptions vary among countries and specific items of income.

A common misunderstanding of US citizens and green card holders living in the Cayman Islands is that they do not need to file US income tax returns if their earned income is less than the foreign earned income and housing exclusions discussed below. In this case the shell corporation earns the companys profits and is subject to the tax laws of the Cayman Islands rather than the United States. The Cayman Islands and the United Kingdom also signed their Agreement to Improve International Tax Compliance which is based on the US Model 1 IGA in 2013.

In March 2009 the Cayman Islands successfully concluded technical negotiations on a series of bilateral agreements with seven Nordic states including tax information agreements and went on to sign additional information agreements. Automatic data exchange as part of the European Union Savings. At the time of signing of this Agreement between the Government of Canada and the Government of the Cayman Islands under Entrustment from the Government of the United Kingdom of Great Britain and Northern Ireland for the Exchange of Information on Tax Matters the undersigned have agreed upon the following provisions which shall be an integral part of this Agreement.

Last reviewed - 08 December 2021. It is not the. The Multilateral Convention on Mutual Administrative Assistance in Tax Matters which allows tax information exchange with more than 140 countries.

Cayman signed its first Mutual Legal Assistance Treaty with the USA in the 1980s and has tax information exchange agreements with 36 jurisdictions. This is entirely untrue. Hereinafter referred to as Cayman Islands tax This Agreement shall also apply to any identical or substantially similar taxes that are.

Since no income taxes are imposed on individuals in the Cayman Islands foreign tax relief is not relevant in the context of Cayman Islands taxation. See the Other issues section in the Corporate summary for a description of Bilateral Agreements that the Cayman Islands has entered into. Taxes of every kind and description.

The existing taxes to which this Agreement shall apply are in particular.

Here Are Some Of The Most Sought After Tax Havens In The World

An Overview Of The Cayman Islands By Ben Hinson Countries Around The World

Why Coronavirus In Cayman Risks Brazilian Offshore Assets By Matthew Feargrieve Medium

Cayman Islands And Cryptocurrency Blockchain And Cryptocurrency Regulations

Economy Of The Cayman Islands Wikiwand

Cayman Islands Offshore Companies And Services Offshorecircle Com

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe

Cayman Islands Tax Agreement Intax Ltd

In Wake Of Brexit Eu To Put Cayman Islands On Tax Haven Blacklist Cayman Islands The Guardian

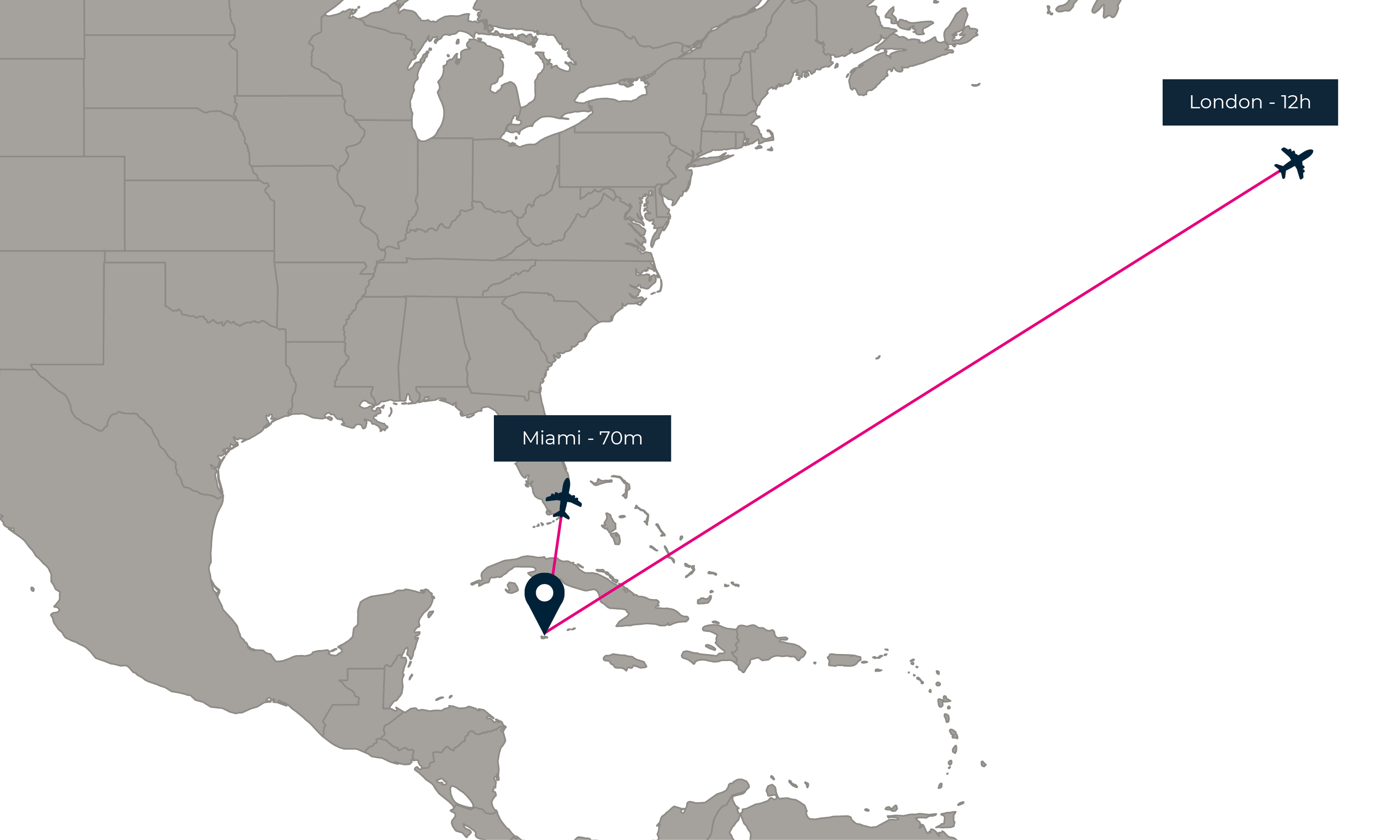

The Cayman Islands Residency By Investment Programme Latitude

Tax Advice For Uk Citizens Moving To Cayman Cayman Resident

The Cayman Islands Residency By Investment Programme Latitude

Is Your Cayman Entity A Private Fund Vistra

A Cloudy Day In Paradise For Pharma Tax Havens In Cayman Islands Bermuda Impact Of Oecd Tax Deal On Pharma In Cayman Islands And Bermuda Tax Haven

What Makes Cayman Islands So Popular For Hedge Funds International Finance

Cayman Islands Introduces Beneficial Ownership Register Regime Vistra

How To Open An Offshore Bank Account In The Cayman Islands

Tiea Between The Cayman Islands The Former Netherlands Antilles To Enter Into Force Orbitax News